Vulkan Vegas, El Casino En Línea N°1 En Perú

април 21, 2022Contents:

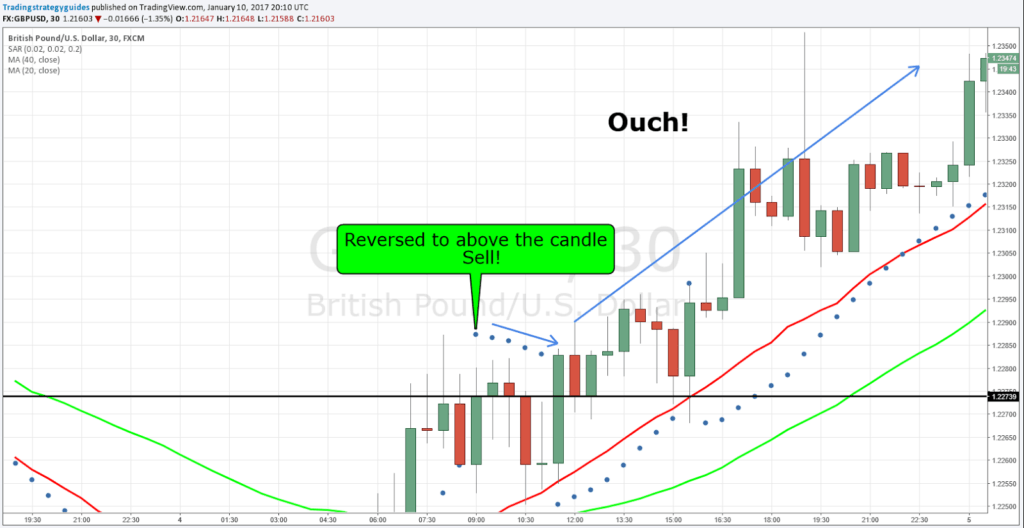

So this is the way by which I am minimizing the positive https://1investing.in/s that I have currently in my portfolio for Jindal Steel and Power. For example, let’s say at 200 rupees, the stock continues to 250 rupees. Then I can specify that this is my downside risk, but this is my upside target.

Washington Nationals news & notes: Nats swept by Rays with 7-2 loss in finale; next stop Colorado… – Federal Baseball

Washington Nationals news & notes: Nats swept by Rays with 7-2 loss in finale; next stop Colorado….

Posted: Thu, 06 Apr 2023 04:01:00 GMT [source]

Trailing Jump is the price difference by which Stop-Loss will move when LTP moves by equal points. This time around, stock exchanges BSE and NSE will remain shut on Thursday for Ram Navami, and trading will resume on Friday after the end of Wednesday’s session. His remarks come on a day when the Indian share market is set for a monthly derivatives expiry due at the end of the session.

Trailing Stop loss Order:

So, what I have to do is that instead of clicking or add or exit, I have to click on this create GTT and the same screen appears here. I just have to pick the trigger price for the stop-loss order and the target order, I have to pick the trigger price here, quantity, price, quantity pricing. And after you’re done that, all you have to do is just create GTT and you are done. You can check that out in the order section and you have to go to the GTT tab.

That means; your primary aim must be to keep your capital from reducing beyond a point. This is a fundamental question that any dealer wants to ask before beginning the trade. The main question is whether a stop Loss must be set at the time of begins the trade or one can view promote and then put the stop loss. In all types of long-standing investing and short-range trading, choosing the right time to exit a place is just as essential as determining the most excellent time to enter your place.

In order to earn a specific reward, you should be stubborn that you will take only a fixed amount of risk. Typically, the last day of a monthly series is marked with high volatility as traders rush to square off their open positions. While you trade in the markets, you always trade with reduced capital.

Investors often enter the market on a limit order and use a protective stop to manage risks. A fixed stop loss is an order triggered in case a predetermined price is reached. If a stop loss is not selected and set up appropriately, it may result in a trade being stopped before it can be profitable.

A stop-loss order is basically a tool used for short-term investment planning. It is used when the investor doesn’t want the pressure of monitoring a security on a day-to-day basis. The trade gets triggered automatically and the limits are decided in advance. Merchants are strongly encouraged to consistently utilize stop-loss orders at whatever point they enter an exchange, to restrict their risk and evade a possibly cataclysmic loss. So, stop-loss orders serve to make trading safer by restricting the measure of capital risked on any single exchange.

Your trailing stoploss will now be activated only after your strategy has an overall profit of 1000 rupees. Once activate at is set, your TSL is now set at a PNL of 0 rupees. A dynamic way of managing risk is to capture every move in your direction. The trailing stop loss commonly referred to as TSL does just that. Trailing stop loss helps you capture the upside when your trade is in your favour and adjust the downside when it’s not.

What was the stop loss set as?

Hence, Grow anarchy is adjusting to providing the shareholder with services and ease to assist people following this investment. Both the purchase and the trade process are accepted within a dealing day. For example, for the same scenario, let’s say that for the same stock, the share price first fell to Rs 94 and then renounced and went up to Rs 105.

For instance, you buy a stock at Rs 100 and the price increases to Rs. 120. You can then set a Trailing Stop Loss at a fixed amount of Rs. 10 or at 5%. The Trailing Stop Loss will be triggered if the stock falls from Rs. 120. If it touches Rs. 110 or falls by 5% to Rs. 114, the Trailing Stop Loss automatically places a sell order and protects your profits. This is mainly since the degree of fluctuation for each stock price will be different. For instance, Stock A’s price may rise or fall by 10% within a month while Stock B tends to move only by 5%.

Attention Investors:

Similarly, it is possible to imagine that for a short position, the Stop Loss will move downwards when the stock prices are decreasing. Some Stock Brokers provide the option to their customers to place this order through online platforms and the price adjustment in the order happens automatically. Otherwise, the traders can also manually update the price in the existing Stop Loss orders, to move it in the direction of their trade.

When we talk of intraday trading, we think of stopping losses. How to calculate stop loss and how to determine to stop loss levels? If you are wondering how to calculate stop loss for intraday trading, you must surely read on. For the sake of simplicity, we will focus only on how to calculate stop loss for intraday trading and not discuss other asset classes.

So for that, what I will have to do here is I have to select ‘create GTT or GTC’. When I click on this, you will see a little screen here and, automatically you will see that the quantity is populated, i.e. the quantity that I have bought in my holdings. One is called a stop-loss order and the other is the Target order.

This allows the trader to capitalize on opportunities as and when they arise. The beauty of the stop loss is that it ensures that you are liquid when it matters the most. If you bought a stock and the stock corrected sharply, then without a stop loss you will be left holding paper when the markets are down. In the process you will miss out on other buying opportunities.

For instance, they may keep up the deception that on the off chance that they give a stock one more opportunity, it will come around. Once you have entered into your strategy, every time your strategies conditions are checked, the Tradetron server will lock a value based on your PNL. Activate at is the PNL after which your trailing stoploss mechanism gets activated.

Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Some brokers may also charge for using the stop loss option as part of the overall brokerage. This can result in additional cost and reduced profits through trades. It is really important to maintain risk and reward while trading in the stock market.

- Here, the trade gets automatically triggered and in advance the limits are decided.

- So, stop-loss orders serve to make trading safer by restricting the measure of capital risked on any single exchange.

- As a trader, you always want to risk only a small portion of your capital on each trade.

- For example, let’s say at 200 rupees, the stock continues to 250 rupees.

In this strategy, the stop-loss order is set to a slightly higher price from the selling price to ensure there are no higher losses. Theoretically, such losses are infinite, and a stop-loss order can ensure there is a minimal risk. Meaning, the trader is risking Rs. 30 as loss per stock, and the stop-loss point or threshold never changes on its own despite the trend changes. The primary and major disadvantage of using stop-loss order is that when there are short-term fluctuations in a share price, it can get activated and adds risk to the investors. Stop loss can be activated even if there are short-term price movements.

Another feature about a stop loss order is that you exit the trade with a loss. However, this loss is a much-restricted loss and could have been worse if there wasn’t a stop loss order placed. Similarly, as explained in Scenario 1 and 2 above, a Stop Loss Limit or Stop Loss Market order could be used with different Trigger Prices and Trade prices. So, when the LTP hits INR 175.50, a Buy Market Order will be placed, which will be matched right away with the existing sellers. Invest in stocks with Free Expert Advice only with MO INVESTOR. One shouldn’t place their stop loss based on arbitrary numbers.

If the LTP of ‘X’ falls to ₹90, a Sell Market Order is sent, and your position gets squared off at market price. Investments in securities market are subject to market risk, read all the related documents carefully before investing. With the year drawing to a close, your thoughts may have turned to taking a holiday and visiting a new destination. Or you may want to just curl up in a blanket and laze around by a bonfire. While you do deserve some rest after toiling for the entire year, one essential task you must not overlook is to check your financial portfolio and ensure it is in good shape.

This is also a tricky point and the correct amount to decide a sell is something one learns as they practice more and more. But primarily guys, if you understood this GTT concept, how you can use these orders, you can very effectively use them to protect your portfolio from incurring some severe losses. Now, let me show the same thing to the mobile app, for those of you who are savvy and who only used the kite app. Then I want to sell, 150 shares at 250 rupees, or I can say 249. Typically what I would recommend is that for an audit on the upside, you have to give a price a little higher.